Adding SEGs Can Give Your Credit Union Stability in an Economic Storm

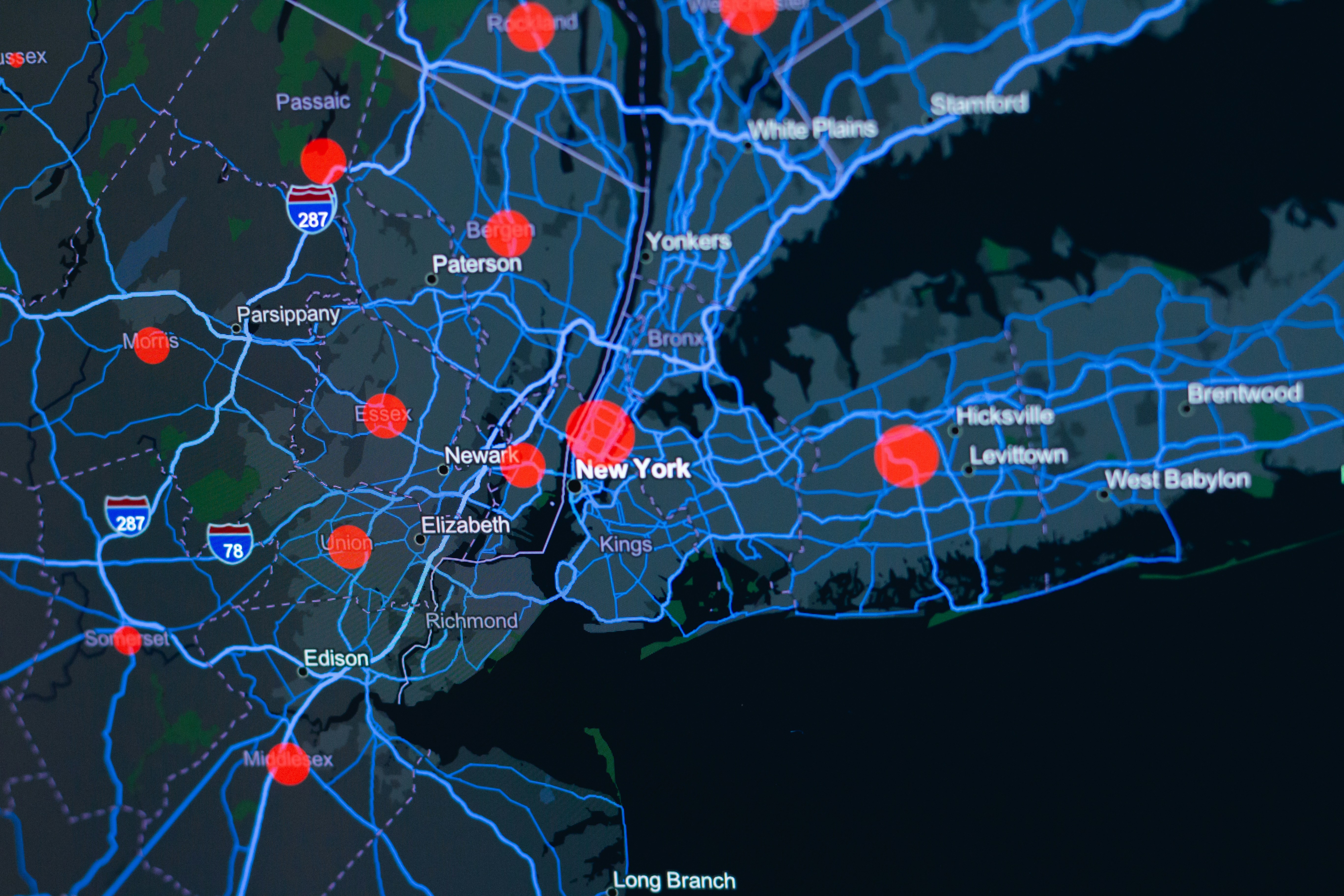

Single and multiple SEG credit unions may add select employee groups to diversity industries or geographies served to expand their field of membership.

Credit unions are looking more strategically at their fields of membership as they navigate uncertain, potentially stormy economic waters to come. Diversifying SEGs (Select Employee Group) for single and multiple common bond credit unions is something every credit union can look at periodically.

Perhaps your credit union has saturated the available market given the competition in the area. Taking loans from competitors by refinancing is a great way of overcoming this issue or expanding your service area can be effective. Expanding your credit union’s reach into new areas or SEGs creates new opportunities to help more consumers join the credit union movement and find their path to a brighter financial future. Credit unions are the best financial option for consumers when considering their superior service and better rates. Saving more people money and guiding them to personal economic stability is what credit unions do, so spreading the wealth is a natural!

CUCollaborate's Field of Membership Handbook is right here to help guide you. Download today!

The Best Approach to Adding new Member Groups

But how and where? First take stock what you already have and determine any gaps, geographical or by business type or industry. For example, if your credit union serves health companies in Miami-Dade County, Fla., you might consider expanding that service into adjacent Broward County. That can help avoid geographic concentration risks. You can do all the research on your own, which can be pretty extensive, or use a tool like CUCollaborate’s ExpandCU to identify companies you would also be serving. In the example below, we searched Broward County health services companies with between 30 and 100 employees, which returned nearly 100 potential companies to target for SEGs. You can even download the results for your records and application.

Or, instead of expanding geographically which can be costly, you might consider SEGs that align with your existing SEGs, such as uniform, biohazard or maintenance companies. Another option would be to truly diversify away from health services should the industry take a major hit financially, and you want to mitigate industry-specific risks.

Once the research is complete, regulatory approval can be a bear, taking several iterations to get it just right. It’s time, money and manpower, while credit union could be doing better things – like serving your members! CUCollaborate guarantees its field of membership applications, so we are 100% here to get your FOM requests approved.

Once you’re approved for your new SEGs, your credit union has to let them know you have arrived! Start with a strong branding campaign to get them familiar with what you stand for and can do for your members and potential members. Work through HR departments to market your credit union as a new employee benefit, attending employee functions or hosting lunch & learns are great ways to get the message out and bring new members in.

CUCollaborate truly believes credit unions are consumers’ best financial option, and we’re here to help you grow and spread the wealth. Contact us today to learn more.

Field of Membership Expansion

.png)

.png)

.png)