As Credit Union Members Evolve, So Does CBS

Despite being one of the smaller credit union core processors, CBS remains one of the fastest growing.

CBS is one of the smaller core processors serving the credit union market, but it’s also been named the fastest growing. CBS Vice President Ken Hunt said he feels that’s in part because it’s helping its credit unions, ranging from $5 million to $400 million in assets, compete in the real world of the financial services marketplace.

“We’re partnering with our credit unions. We want the $50 million credit unions to be able to compete with the big guys,” Hunt said. Credit union members have evolved, he pointed out. He recalled walking through a manufacturing plant 20 years ago for a meeting at a credit union. It was neat to have that type of relationship between the employee group and the credit union, Hunt said, but today, members’ relationships are with their phones.

One of CBS’ major initiatives this year is to refresh its mobile app in the third quarter, which will come after it upgrades its IB-ii internet banking offering, the second of three key initiatives for 2019. While its core product, CAMS-ii, is a critical part for CBS and its client credit unions, efforts needed to shift to position CBS for the future. “The mindset as a company for years was it’s all about the core. I’ve seen how it’s shifted for credit unions. Instead of the core, credit unions’ shift in focus is with members and their access,” Hunt observed. So, CBS hired new people and started a department focused entirely on its consumer-facing products, including IB-ii and mobile, so that development can evolve more quickly in those areas.

While CBS offers several products around its core, from mobile card control to data management, to help smaller credit unions be competitive, some larger credit unions are pursuing best of breed strategies, which leads to its third big initiative for 2019: an API to make it easier for credit unions to work with third parties. “We like to think we’re offering the best of both worlds,” Hunt said. “The API will allow flexibility for larger credit unions that can afford to invest in best of breed, instead of writing to different individual interfaces for each third-party provider.”

Hunt added, “It’s all about member convenience, trying to make it easier for our credit unions to offer member convenience.”

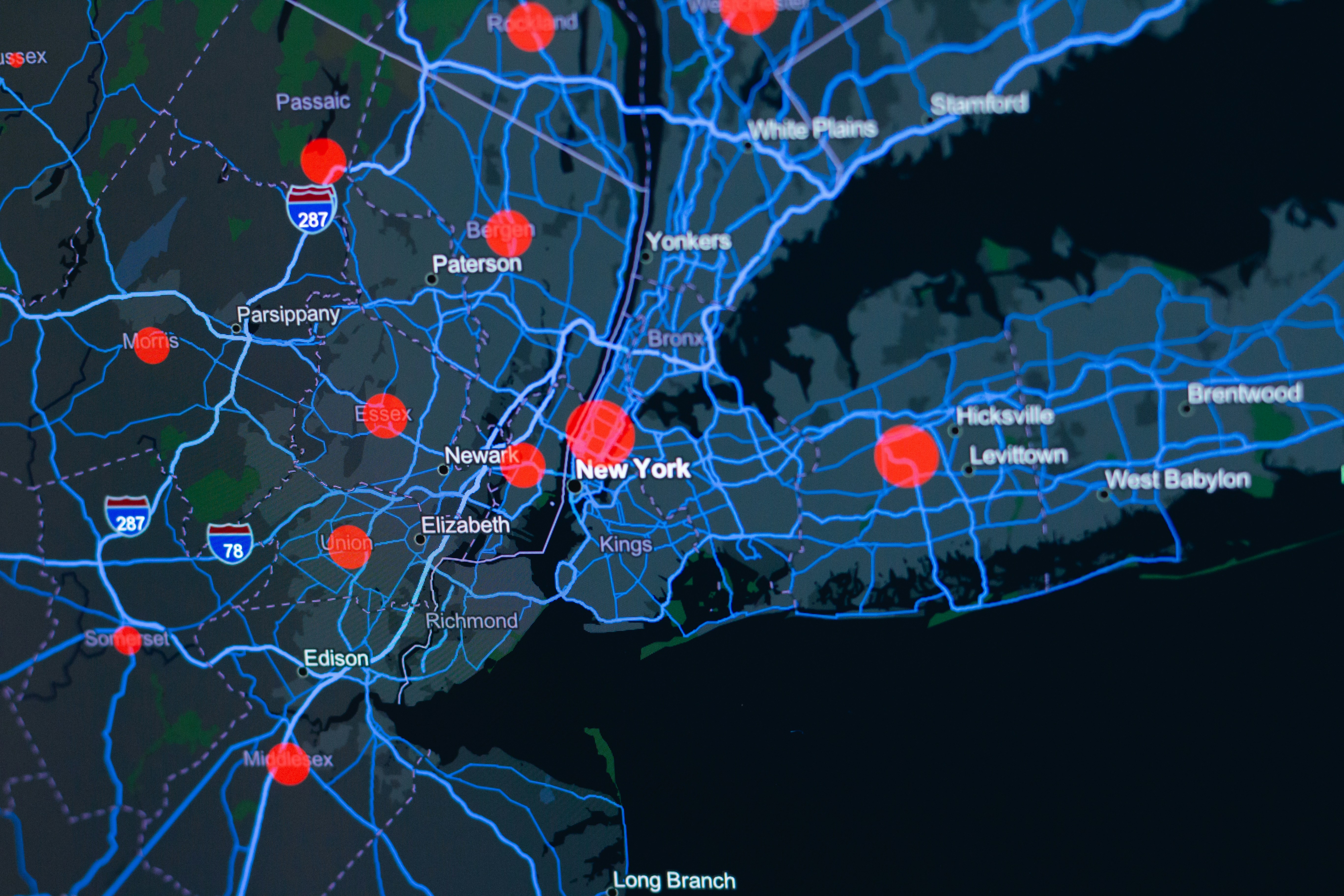

CBS exclusively serves credit unions, and after adding seven new clients last year, its total client list is up to 55 across 14 states. “The industry is changing. There are a lot of consolidations,” Hunt commented, “but we can be of benefit to credit unions.” He explained that CBS will structure their contracts, so it’s easier for a credit union to get in and provide new services and training, but they have to want to be more. “It’s an opportunity for us as a company to help a credit union. We do see this is good for the credit union industry. Credit unions being merged is not good for anyone.”

Banking Technology & Innovation

.png)

.png)

.png)